The EUR/USD currency pair experienced a significant rise on Friday, mainly due to favorable macroeconomic data for the euro. In both the Eurozone and Germany, business activity indices reported relatively strong figures, although they remain below ideal levels—indicating that Europe's economy is still not stable and lacks substantial growth. In contrast, U.S. business activity indices and the consumer sentiment index showed weaker results, creating a "double blow" for the dollar, which had already faced challenges earlier in the week due to Donald Trump's "draconian" plans.

However, the increase in the euro shouldn't be misleading. While business activity indices are important forward-looking indicators, there are no clear signs of positive change in the European economy. Meanwhile, the U.S. economy continues to demonstrate exceptional performance. The European Central Bank (ECB) plans to raise its interest rate to 2% by summer, while the Federal Reserve (Fed) anticipates only two rate cuts at most throughout 2025. Therefore, the overall global economic environment for both the euro and the dollar remains unchanged.

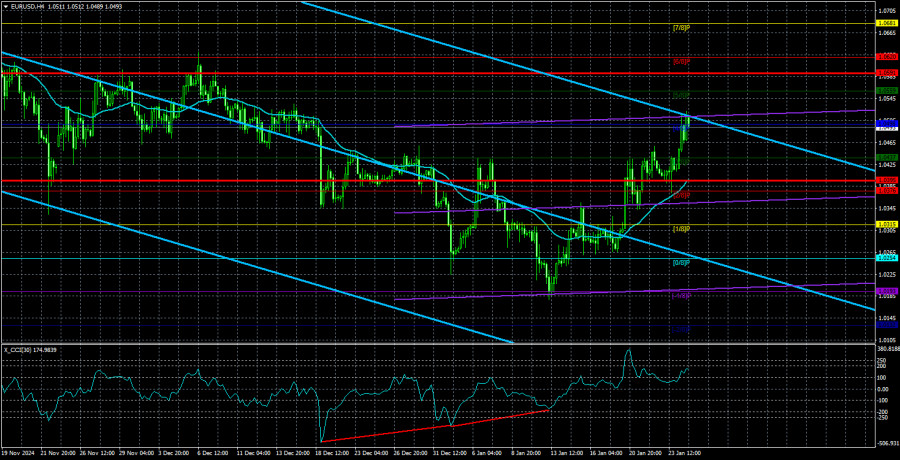

We have been cautioning about a potential correction on the daily timeframe for some time, and it has now begun. The market took advantage of Friday's data to push the pair higher. If the business activity data had been absent or less favorable for the euro, the rise would still have likely occurred—if not on Friday, then on Monday. However, the CCI indicator has already reached overbought territory and could soon exhibit a bearish divergence.

The upcoming week is filled with important events. On Monday, Christine Lagarde will speak in the Eurozone, followed by another speech on Tuesday. Wednesday will bring several key reports: Germany's Q4 GDP report, the Eurozone's Q4 GDP report, the conclusion of the ECB meeting, and yet another address from Lagarde. On Friday, we can expect German retail sales, inflation data, and the unemployment rate. Clearly, there is a wealth of macroeconomic releases coming from the Eurozone, and that's not even considering the U.S. events!

This week, the technical landscape could change significantly. The ECB is expected to maintain its dovish stance with complete certainty, while the Fed is anticipated to remain hawkish. These two factors combined make it unlikely for the euro to experience a strong and prolonged rally. Currently, on the daily timeframe—which is the most critical—the price has broken above the Kijun-sen line and is approaching the Senkou Span B line. This is likely where the upward correction may come to an end. While the correction could take longer than initially expected, we do not foresee the pair rising above 1.0640 during the first quarter of 2025.

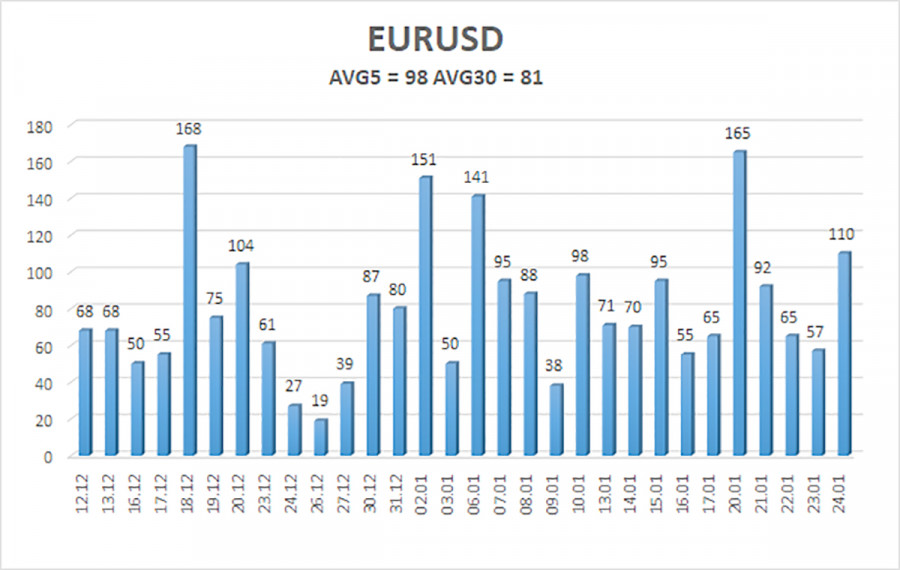

The average volatility of the EUR/USD currency pair over the last five trading days as of January 27 is 98 pips, categorized as high. On Monday, we expect the pair to move from 1.0395 to 1.0591. The higher linear regression channel remains downward, indicating that the global bearish trend persists. The CCI indicator has entered the overbought zone, signaling a potential resumption of the downtrend. A bearish divergence may still form, potentially triggering a new decline.

Nearest Support Levels:

- S1 – 1.0437

- S2 – 1.0376

- S3 – 1.0315

Nearest Resistance Levels:

- R1 – 1.0498

- R2 – 1.0559

- R3 – 1.0620

Trading Recommendations:

The EUR/USD pair continues its upward corrective movement. Over the past few months, we have consistently stated that we expect the euro to decline in the medium term, and we believe this downtrend is not yet over. The Fed has paused its monetary policy easing, while the ECB is accelerating its easing measures. As such, the dollar has no fundamental reasons for a medium-term decline apart from purely technical corrections.

Short positions remain relevant with targets at 1.0254 and 1.0193, but the current correction needs to be completed first. This correction could end near the 1.0640 level. If you trade purely on technical analysis, long positions can be considered if the price holds above the moving average, with targets at 1.0559 and 1.0620. However, any growth at this stage is considered part of the ongoing correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.