Analysis of Trades and Trading Tips for the British Pound

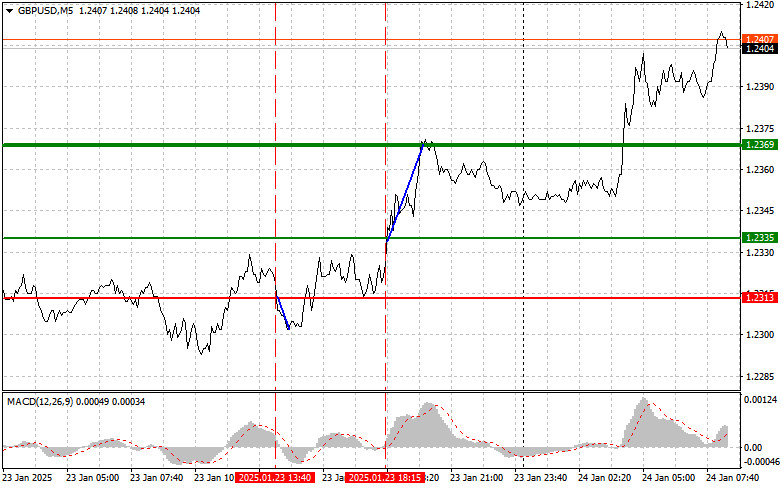

The test of the 1.2335 price level in the afternoon occurred when the MACD indicator had just begun to move upward from the zero mark, confirming a valid entry point for buying the pound. As a result, the pair rose by more than 40 pips. However, selling at the 1.2313 level did not yield the expected profit.

Additionally, Donald Trump's recent speech regarding trade tariffs and new duties did not mention the UK, allowing the British pound to recover its positions. This absence of reference created optimism that the UK might avoid trade conflicts, encouraging traders to view the British market as a viable alternative. The lack of mentions of the UK in the context of trade tariffs might also indicate that the US seeks more balanced relations, which could open up new opportunities for trade cooperation between the two nations and lay a positive foundation for further growth of the pound.

Today, several data releases are expected that could impact the pound. If the PMI figures exceed expectations, the pound may strengthen as investors look to capitalize on the potential for the Bank of England to maintain interest rates. A recovery in the manufacturing sector would indicate economic health and enhance confidence in the BoE's monetary policy. Conversely, if the data falls short of forecasts, the pound could face pressure, resulting in corrections on the charts. In such a scenario, investors might start closing long positions in anticipation of further weakness in the pound.

As for my intraday strategy, I will primarily rely on the implementation of Scenarios #1 and #2 outlined below.

Buy Signal

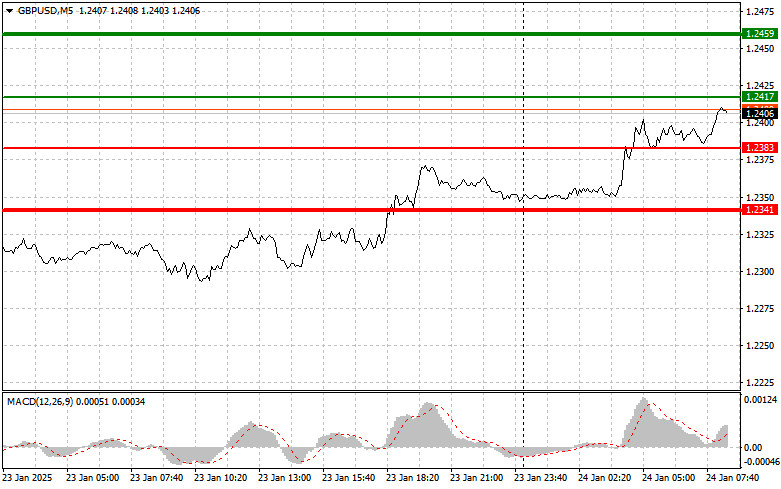

Scenario #1: I plan to buy the pound today at 1.2417 (green line on the chart) with a target of 1.2459 (thicker green line on the chart). At 1.2459, I plan to exit purchases and open short positions, expecting a 30-35 pip retracement from the entry point. Pound growth can be expected following strong data. Important: Before buying, ensure that the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy the pound today if the price tests the 1.2383 level twice consecutively, with the MACD indicator in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. Growth toward the 1.2417 and 1.2459 levels can be anticipated.

Sell Signal

Scenario #1: I plan to sell the pound today after a breakout below the 1.2383 level (red line on the chart), which could lead to a rapid decline in the pair. The primary target for sellers will be 1.2341, where I plan to exit sales and open immediate long positions, expecting a 20-25 pip rebound from the level. Selling the pound is preferable at higher levels in anticipation of a return to the bearish trend. Important: Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I plan to sell the pound today if the price tests the 1.2417 level twice consecutively, with the MACD indicator in the overbought zone. This will limit the pair's upside potential and lead to a market reversal downward. Declines toward the 1.2383 and 1.2341 levels can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.